Agri Fintech KiVi closes seed round, positions to serve Farmgate Ecosystem with credit, commerce and distribution

Agri-fintech startup KiVi, operated by Agrosperity Tech Solutions Private Limited, has announced the conclusion of its seed round of Rs 15 crore led by Caspian Leap for Agriculture Fund, Piper Serica Angel Fund, YAN Angel Fund, Impact Innovators and Entrepreneurs Foundation, among others. KiVi is incubated at IIT-Madras Research Park and stands for kisan vikas - farmer development.

Agri-fintech startup KiVi, operated by Agrosperity Tech Solutions Private Limited, has announced the conclusion of its seed round of Rs 15 crore led by Caspian Leap for Agriculture Fund, Piper Serica Angel Fund, YAN Angel Fund, Impact Innovators and Entrepreneurs Foundation, among others. KiVi is incubated at IIT-Madras Research Park and stands for kisan vikas - farmer development.

Sharing details about the seed round and the way forward, Joby C O, Founder & CEO said, “We are excited to welcome our first institutional investors who share KiVi’s vision to make agriculture a livelihood of choice by enabling credit, commerce and distribution to the farmgate ecosystem.”

Apart from Joby, who is a veteran in rural leading, KiVi’s founding team includes Padmakumar K, Rajendra Kumar, Salil Nair and Manoj Ramaswamy who bring rich execution experience in rural lending, agri commerce, rural technologies and fund raise.

The farmgate ecosystem comprises farmer households and agri entrepreneurs such as input retailers, output aggregators, farmer producer organizations and equipment renters. While the farmgate ecosystem presents a large market opportunity for credit and commerce, it has been under-served by the formal markets due to lack of solutions that address the unique characteristics of the stakeholders.

Seasonal cash flows, absence of formal income proof and land ownership proof, fragmented landholding, inability of traditional lenders to build a cost-effective delivery model and participate in the adjacent commerce opportunities and are the key gaps that KiVi is addressing.

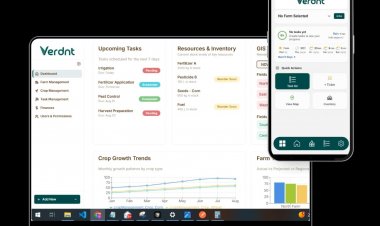

Joby further added, “KiVi enables timely, affordable and scale-based credit as well as commerce from the farmgate to the processor. We accomplish this by leveraging our technology and last mile transaction capability. Our technology platform assembles and integrates the latest technologies in identification, validation, consent, evaluation and monitoring to provide a seamless experience to all stakeholders. Our last mile capability provides the customer relationship interface that is critical to serve the agri and rural customer base.”

KiVi has seen early validation of its offerings with 80% of customers enjoying agri-specific loan for the first time, 60% experiencing an increase in their income and a net promoter score of 77. Further, KiVi has partnered with leading lending institutions. KiVi is operational in Tamil Nadu and Bihar and has till date enabled over 1,500 farmers to access credit, launched MSME loan offerings to agri entrepreneurs and enabled commerce and trade finance in commodities including wheat, paddy and maize.

“We are excited about our investment in KiVi. The agri fintech space is ripe for innovation and disruption, though having many challenges, including the perceived risk with agri credit. We believe that KiVi, led by Joby, has the right blend of people with rich experience of rural financial services and agriculture to make this happen,” said Emmanuel Murray, Investment Director at Caspian Leap for Agriculture Fund.

“KiVi is cultivating a vital solution for the farmgate ecosystem bridging the gap between borrowers and lenders. We are excited to support a company with a visionary management team and their commitment to addressing one of the most critical challenges for the future of agriculture and rural economies,” said Abhay Agarwal, Principal at Piper Serica Angel Fund.

“The investment will help KiVi to build a robust technology platform for scale-up, increase the last-mile presence across many districts, strengthen the product and risk capabilities and obtain an NBFC license,” Joby concluded.

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group