Aided by high demand, agrochemicals sector cruises through headwinds

The agrochemicals sector (excluding fertilisers) has experienced significant demand growth in recent years, driven by factors such as normal monsoon patterns, increased fertilizer subsidy budgets, improved exports, and new opportunities in custom synthesis manufacturing. Indian companies have embraced these favourable prospects by embarking on significant capital expenditures, and comparable investments are presently in progress.

The agrochemicals sector (excluding fertilisers) has experienced significant demand growth in recent years, driven by factors such as normal monsoon patterns, increased fertilizer subsidy budgets, improved exports, and new opportunities in custom synthesis manufacturing. Indian companies have embraced these favourable prospects by embarking on significant capital expenditures, and comparable investments are presently in progress.

While the long-term prospects of the sector remain promising, it has faced challenges in the post-H1FY23 period. These challenges primarily stem from increased channel inventory and a decline in input prices, which have resulted in inventory losses. Consequently, there has been a decline in sales growth in FY23, accompanied by a moderation in operating profitability.

Looking ahead, CareEdge Ratings projects sales growth to moderate to 10%-12% in FY24. This is expected to exert pressure on operating profitability in the near term. Despite the likely moderation in profitability, the credit profile of Indian agrochemical companies in general is expected to remain strong due to their strong balance sheets and significant deleveraging in the past few years. India’s total sales of agrochemicals had seen decent growth till FY22 (barring FY20 due to the impact of Covid) which was backed by robust domestic demand, improving exports, adequate budgets for fertilizer subsidy and a normal monsoon.

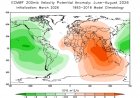

However, sales growth moderated to 13% in FY23 which was decent considering an already high base of FY22 due to high channel inventory. Going forward, we expect sales growth to moderate to around 10% -12% in FY24 due to available channel inventory as of end-FY23, the potential impact of El-Nino weather conditions on the monsoon this year and the decline in input prices.

The operating profitability margin for agrochemical companies remained healthy at 14% to 15% in FY21 & FY22. It, however, moderated to 13% in FY23 due to impact of the decline in input prices leading to inventory losses, especially in H2FY23. Going ahead, in line with the likely moderation in sales growth in FY24, operating profitability is also expected to remain under pressure in the near term.

The sector is highly capital intensive and sizeable capex has happened in the last few years whereas sizeable capex is lined up for this year too. This capex is largely towards expanding the existing product capacities, expanding the distribution network, inorganic acquisitions, backward integration, new product development and their launch in the market. In case we see pressure on the operating profitability sustaining in H1FY24, there could be some slowdown in the capex in H2FY24.

“Long-term growth prospects of India’s agrochemicals sector remain intact on the back of robust domestic demand, improving export demand on the back of China + policy, good scope for backward integration in manufacturing technicals and key intermediates, competitive cost structure in India, good prospects from custom synthesis manufacturing and adequate fertilizer subsidy budgets.

“Sensing this opportunity, sizeable capex is also undertaken by Indian companies to grab the opportunity while balance sheets of Indian agrochemical companies have generally become stronger over a period providing an adequate headroom. In the near term, however, there are few headwinds in the form of high channel inventory, declining input prices, higher supplies from China and uncertain weather conditions due to El Nino which are likely to result in lower sales growth with pressure on operating profitability margins in FY24,” said Hardik Shah, Director at CareEdge Ratings.

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group