Need for a Budget with major changes and steps for agriculture

There are strong chances of it being a normal financial year for the country’s economy after the Covid-19 pandemic crisis. Given this situation, Union Budget 2021-22 can make the most vital contribution in pushing the agenda of the government forward as the latter will have time to attain the direction and targets decided in this Budget.

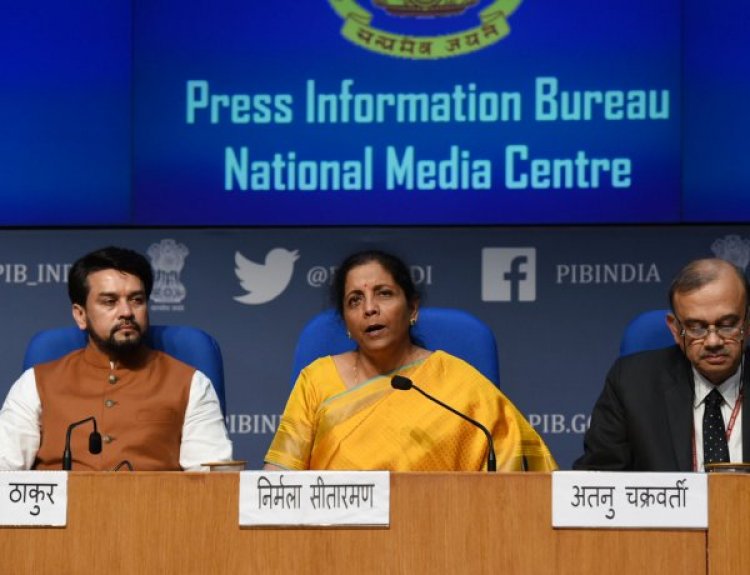

The Budget to be presented by Finance Minister Nirmala Sitharaman on coming February 1 should be a make-or-break one for the government as the current government at the centre has completed a third of its tenure and there are strong chances of it being a normal financial year for the country’s economy after the Covid-19 pandemic crisis. Given this situation, Union Budget 2021-22 can make the most vital contribution in pushing the agenda of the government forward as the latter will have time to attain the direction and targets decided in this Budget.

It is in view of this situation that the government should propose in this Budget bold provisions involving major changes for agriculture and allied sectors. Besides the steps targeted at farmers’ income, there should be provisions for fundamental changes on the tax front that should treat agriculture as a business, where the focus should be on commercial interests rather than on grants. The largest share of the government’s financial resources for the agriculture sector is given in the budget in the form of Pradhan Mantri Kisan Samman Nidhi (PM-Kisan) and fertilizer subsidies. The need is to emphasize their better and targeted use.

Given the current political scenario in which Assembly elections are to be held in West Bengal and other states and the farmers’ movement is going on against the three farm laws, there is speculation that the government could increase the allocation for PM-Kisan. The amount is likely to go up from the present six thousand rupees to nine thousand rupees per annum. This may fetch some political gains but the scheme in its present form is not beneficial for farmers and the agriculture sector in the long run. All agriculture experts agree that direct cash transfers to all farmers in the form of universal income cannot benefit them; instead, these need to be targeted. The government is spending more than half of the amount of the agriculture budget under PM-Kisan. Hence it is necessary to put it to better use. An integrated policy of Minimum Support Price (MSP) and Direct Benefit Transfer (DBT) together may work in encouraging the farmers for better production and crop diversification. It would be better to ensure maximum purchase for crops for which MSP is announced and grant the finances under PM-Kisan for non-MSP crops. Farmers may thus be encouraged to go for these crops. In a conversation with RuralVoice, Prof. Ramesh Chand, Member, Niti Aayog, too said that incentives like DBT and MSP are both schemes that need to be run in a combined form.

Another step that needs to be taken is that the government should make the collective Farmer Producer Organisation (FPO) of the farmers financially more attractive. It is also the aim of the government to create more and more FPOs, under which the farmers may increase their income through better marketing as well as reduce their cost of production. The FPOs may now be created in the form of companies and cooperatives both. The government should, therefore, exempt FPOs from income tax. Bringing the farmers who form a company together within the purview of corporate tax means they are being taxed. Such a provision may discourage the farmers from coming together as FPOs. So, it should be clearly stated that FPOs will be exempted from the tax net.

Bringing about provisions in the Budget to reduce the production costs in agriculture is another necessary step. There are three ways to increase farmers’ income — reduce the production costs, increase productivity and make better prices available to the farmers for their produce. Among these, a direct solution to reducing the production cost lies with the government and it is an easy one. The tax rates on agricultural inputs should be reduced under the Goods and Services Tax (GST) regime. Companies and traders benefit from the input tax credit in industrial production and services, but this is not possible in the case of farmers as there is no such process at their level. Therefore, GST on fertilizers, pesticides, tractors and other machinery should be brought down to six per cent. Such provisions should also be made for the technology employed in agriculture because its use is fast increasing and technology is required for an increase in agricultural production and productivity and improvement in quality.

The government has largely focused on crops. But it should change its focus and increase the budgetary provisions for animal husbandry, dairy and fishery because their share in agriculture GDP is going up and these sectors are emerging as major sources for farmers’ income. So, it is necessary to give proportional importance to these sectors while making budgetary provisions.

Besides, there is a need for a massive increase in the budgetary allocation for research in agriculture and allied sectors. We have been talking for decades about targeting one per cent of agriculture GDP for research, but it is still far lower. A lot needs to be done in agricultural research in India regarding the challenges faced on account of environmental problems and climate change. The country is still almost totally dependent on the public sector for this. Therefore, the government should emphasize more on this issue in the budget. Also, an effort should be made that the private sector does not merely get into agriculture for commercial gains but also increase its participation in agricultural research.

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group