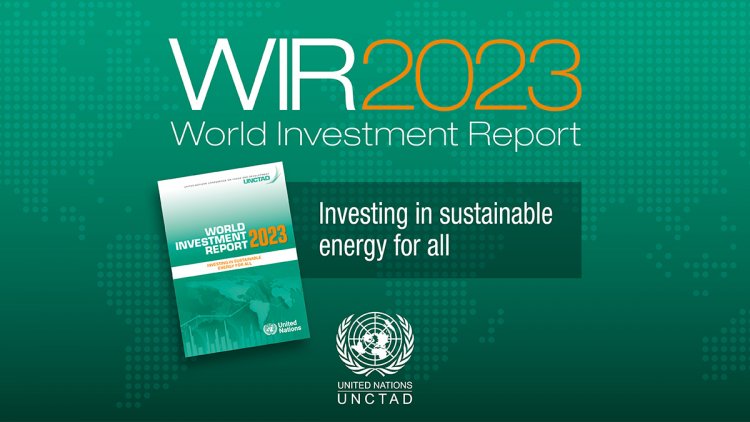

UNCTAD for urgent support to developing countries to attract massive investment in clean energy

Developing countries need renewable energy investments of about $1.7 trillion annually but attracted foreign direct investment in clean energy worth only $544 billion in 2022, according to the report. Total funding needs for the energy transition in developing countries are much larger and include investment in power grids, transmission lines, storage and energy efficiency. UNCTAD Secretary-General Rebeca Grynspan said: “A significant increase in investment in sustainable energy systems in developing countries is crucial for the world to reach climate goals by 2030.”

The United Nations Conference on Trade and Development (UNCTAD) Wednesday called for urgent support to developing countries to enable them to attract significantly more investment for their transition to clean energy. UNCTAD’s World Investment Report 2023 shows that much of the growth in international investment in renewable energy, which has nearly tripled since the adoption of the Paris Agreement in 2015, has been concentrated in developed countries.

Developing countries need renewable energy investments of about $1.7 trillion annually but attracted foreign direct investment in clean energy worth only $544 billion in 2022, according to the report. Total funding needs for the energy transition in developing countries are much larger and include investment in power grids, transmission lines, storage and energy efficiency. UNCTAD Secretary-General Rebeca Grynspan said: “A significant increase in investment in sustainable energy systems in developing countries is crucial for the world to reach climate goals by 2030.”

Compact for sustainable energy investment

The report proposes a compact setting out priority actions ranging from financing mechanisms to investment policies to enable developing countries to attract investments to build sustainable energy systems. On financing, the report calls for the de-risking of energy transition investment in developing countries through loans, guarantees, insurance instruments and equity participation of both the public sector – through public private partnerships and blended finance – and multilateral development banks. Also, partnerships between international investors, the public sector and multilateral financial institutions can significantly reduce the cost of capital for clean energy investment in developing countries.

UNCTAD also emphasises the need for debt relief to offer developing countries fiscal space to make the investments necessary for the clean energy transition and to help them attract international private investment by lowering country risk ratings.

Renewable energy investment growth slows

The report shows that the growth of investment in renewable energy slowed down in 2022, as international project finance deals declined. Although total international investment in renewables has nearly tripled since 2015, in developing countries the growth rate has exceeded GDP growth only marginally.

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group