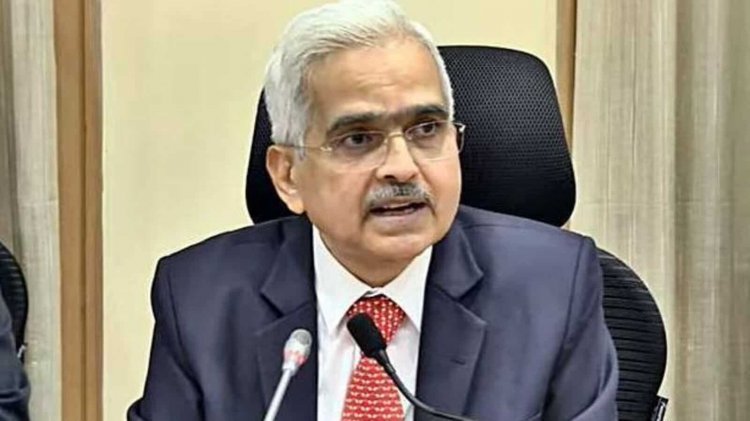

RBI raises repo rate by 50 basis points to 5.4 per cent; home and other loans to get costlier

The six-member MPC of the RBI at its meeting on August 5 hiked the repo rate by 50 bps with immediate effect. At 5.4 per cent now, the policy rate has gone back to the late-2019 levels. The RBI move is set to increase lending rates and add to the burden of borrowers, including home loan customers. On the other hand, bank depositors will get higher returns.

The six-member Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) at its meeting on August 5 hiked the repo rate, the key lending rate, by 50 basis points (bps) with immediate effect. At 5.4 per cent now, the policy rate has gone back to the late-2019 levels.

Consequently, the standing deposit facility (SDF) rate stands adjusted to 5.15 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 5.65 per cent, says the RBI press release.

The MPC also decided to remain focused on the withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The RBI feels that “domestic economic activity remains resilient.” As of August 4, 2022, says the press release, the southwest monsoon rainfall was 6 per cent above the long period average (LPA). Kharif sowing is picking up. High-frequency indicators of activity in the industrial and services sectors are holding up. Urban demand is strengthening while rural demand is gradually catching up. Merchandise exports recorded a growth of 24.5 per cent during April-June 2022, with some moderation in July. Non-oil non-gold imports were robust, indicating strengthening domestic demand.

Although the CPI inflation eased to 7 per cent during May-June 2022, it persists above the tolerance band, says the RBI. Food inflation has registered some moderation, especially with the softening of edible oil prices, and deepening deflation in pulses and eggs. But fuel inflation moved back to double digits in June, primarily due to the rise in LPG and kerosene prices.

This is the third consecutive rate hike after an increase of 40 bps in May and 50 bps in June. Thus, the RBI has raised the benchmark rate by 1.4 per cent since May this year.

Dr VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, says, “The 50bp repo rate hike came 15bp higher than the majority expectation of a 35bp hike. It is evident that the MPC is frontloading the rate hikes since it feels that ‘CPI inflation is above comfort levels.’ The MPC has been emboldened to go for this 50bp hike since ‘the economic activity is resilient’ and ‘withdrawal of accommodation stance is necessary to anchor inflation expectations’.”

“The RBI governor went so far as to say that ‘the Indian economy is holding steady in an ocean of turbulence.’ The capacity utilization in industry at 75 per cent is higher than the long-term average. This positive view on the economy has been well received by the stock market in spite of the higher-at-hand expected repo rate hike,” adds Vijayakumar.

The RBI move is set to increase lending rates and add to the burden of borrowers, including home loan customers. A rate hike means banks will have to pay more for the money they borrow from the RBI. As a result, banks pass on the cost to borrowers by increasing their own interest rates on loans. This makes equated monthly instalments (EMIs) costlier.

Anuj Puri, Chairman, ANAROCK Group, says, “A rate hike was expected, but the expectation was for a maximum of 35 bps. The hike by 50 bps is definitely on the higher side, and home loan lending rates will now edge further into the red zone.” He adds, “This whammy comes along with the inflationary trends of primary raw materials, including cement, steel, labour, etc., that have recently led to a rise in property prices. Together, these factors – rising home loan rates and construction costs – will impact residential sales that did reasonably well in the first half of 2022.”

However, Dr Niranjan Hiranandani, National Vice Chairman, Naredco and MD, Hiranandani Group, is hopeful. He says, “As the home loan borrowing is at the flexible rate, short-term interest rate spike will certainly hurt the homebuyers’ sentiments, but it averages out the cost positively in the long term.” He adds, “Real estate continues to be a good bet for investment with sustainable consumption demand at play even after the interest rate cycle wanes off.”

On the other hand, the repo rate hike is good news for bank depositors. They will get higher returns on their deposits depending on how banks pass on the new interest rate hike. These deposits include fixed deposits.

Nilesh Shah, Group President & MD, Kotak Mahindra Asset Management Company, says, “Since growth is becoming broad-based and private Capex is showing signs of revival, the RBI has front-loaded repo rate hike to control inflation. Interestingly, the RBI has kept the Indian economy flying high (7.2 per cent GDP growth in FY23) through turbulent weather. The RBI has clearly differentiated itself vis-a-vis many other central banks which are looking to hard land their economy (recession in FY23) to bring down inflation.”

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group