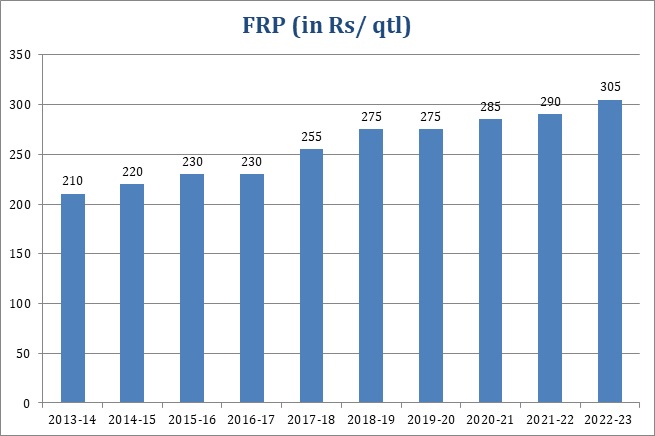

CCEA decides to raise sugarcane FRP for next season to Rs 305 per quintal, up by Rs 15

Keeping in view the interest of sugarcane farmers, the Cabinet Committee on Economic Affairs chaired by Prime Minister Narendra Modi has approved the Fair and Remunerative Price (FRP) of sugarcane for sugar season 2022-23 (October-September) at Rs 305 per quintal. This is Rs 15 per quintal more than the FRP for the current season, which is Rs 290 per quintal.

Keeping in view the interest of sugarcane farmers, the Cabinet Committee on Economic Affairs (CCEA) chaired by Prime Minister Narendra Modi has approved the Fair and Remunerative Price (FRP) of sugarcane for sugar season 2022-23 (October-September) at Rs 305 per quintal. This is Rs 15 per quintal more than the FRP for the current season, which is Rs 290 per quintal.

The CCEA has approved this FRP for a basic recovery rate of 10.25 per cent, providing a premium of Rs 3.05 per quintal for each 0.1 per cent increase in recovery over and above 10.25per cent, and a reduction in FRP by Rs 3.05 per quintal for every 0.1 per cent decrease in recovery.

However, the Government with a view to protecting interests of sugarcane farmers has also decided that there shall not be any deduction in the case of sugar mills where recovery is below 9.5 per cent. Such farmers will get Rs. 282.125 per quintal for sugarcane in the ensuing sugar season 2022-23 in place of Rs 275.50 per quintal in the current sugar season 2021-22.

According to the press release from the CCEA, the government has increased FRP by more than 34 per cent in the past eight years. The decision will benefit 5 crore sugarcane farmers and their dependents, as well as 5 lakh workers employed in the sugar mills and related ancillary activities, says the release. In the current sugar season 2021-22, about 3,530 lakh tonnes of sugarcane worth Rs 1,15,196 cr was purchased by sugar mills, which is an all-time high.

Keeping the increase in the acreage and expected production of sugarcane in the ensuing sugar season 2022-23, more than 3,600 lakh tonnes of sugarcane is likely to be purchased by sugar mills for which the total remittance to the sugarcane farmers is expected to be more than Rs 1,20,000 crore. The government through its pro-farmer measures will ensure that sugarcane farmers get their dues in time.

India largest producer and second-largest exporter of sugar in the world

India has surpassed Brazil in sugar production in the current sugar season. With the increase in the production of sugar in the past eight years, India, apart from meeting its requirement for domestic consumption, has also consistently been exporting sugar, which has helped in reducing our fiscal deficit. In the last four sugar seasons, viz. 2017-18, 2018-19, 2019-20 and 2020-21, about 6 lakh metric tonnes (LMT), 38 LMT, 59.60 LMT and 70 LMT of sugar have been exported. About 100 LMT of sugar has been exported till 1 August 2022 in the current sugar season 2021-22 and exports are likely to touch 112 LMT.

Sugarcane farmers and sugar industry now contributing to energy sector

India’s 85 per cent requirement of crude oil is met through imports. But with a view to reducing import bills on crude oil, reducing pollution amd making India Atmanirbhar in the petroleum sector, the government is proactively moving ahead to increase production and blending of ethanol with petrol under the Ethanol Blended with Petrol programme. The government is encouraging sugar mills to divert excess sugarcane to ethanol which is blended with petrol, which not only serves as a green fuel but also saves foreign exchange on account of crude oil import. In sugar seasons 2018-19, 2019-20 and 2020-21, about 3.37 LMT, 9.26 LMT and 22 LMT of sugar have respectively been diverted to ethanol. In the current sugar season 2021-22, about 35 LMT of sugar is estimated to be diverted and by 2025-26, more than 60 LMT of sugar is targeted to be diverted to ethanol, which would address the problem of excess sugarcane as well as delayed payment issue because farmers would get timely payment.

The government has fixed a target of 10 per cent blending of fuel-grade ethanol with petrol by 2022 and 20 per cent blending by 2025.

Till the year 2014, the ethanol distillation capacity of molasses-based distilleries was only about 215 crore litres. However, in the past eight years, due to the policy changes made by the government, the capacity of molasses-based distilleries has increased to 595 crore litres. The capacity of grain-based distilleries, which was about 206 cr litres in 2014, has now increased to 298 cr litres. Thus, the overall capacity of ethanol production has doubled in the past eight years from 421 cr litres in 2014 to 893 cr litres in July 2022. The government is also extending interest subvention to sugar mills/ distilleries for loans availed from banks for augmentation of ethanol production capacities. About Rs 41,000 cr investment is being made in the ethanol sector which will create employment opportunities in rural areas.

In ethanol supply year (ESY) 2013-14, the supply of ethanol to oil marketing companies (OMCs) was only 38 crore litres with blending levels of only 1.53 per cent. The production of fuel-grade ethanol and its supply to OMCs has increased by eight times from 2013-14. In ESY 2020-21 (December-November), about 302.30 cr litres of ethanol has been supplied to OMCs, thereby achieving 8.1 per cent blending levels. In the current ESY 2021-22, India has been able to achieve 10.17 per cent blending levels. More than 400 cr litres of ethanol is likely to be supplied by sugar mills/distilleries for blending with petrol in the current ESY 2021-22. This will be 10 times in comparison to the supplies in the year 2013-14.

Since 2013-14, about Rs 49,000 crore in revenue has been generated by sugar mills from the sale of ethanol to OMCs. In the current sugar season 2021-22, about Rs 20,000 cr revenue is being generated by sugar mills from the sale of ethanol to OMCs, which has improved the liquidity of sugar mills, enabling them to clear the farmers’ cane dues. The revenue from the sale of sugar and its by-products, ethanol supplies to OMCs, power production from bagasse-based cogeneration plants and sale of potash produced from press mud has improved the topline and bottomline growth of sugar mills.

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group