Amid dispute between India and Pakistan over Basmati GI tag, New Zealand rejects India’s application

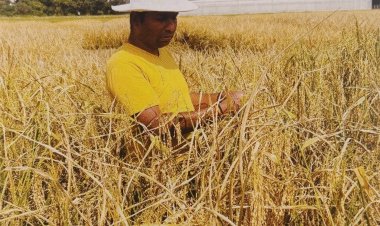

India is facing increasing difficulties in securing Geographical Indication (GI) status for Basmati rice in the global market, which has an annual export value of about Rs 50,000 crores. Both India and Pakistan are staking claims over the GI of Basmati. Amid this dispute, New Zealand has rejected India's trademark application for Basmati, following Australia's earlier decision.

India is facing increasing difficulties in securing Geographical Indication (GI) status for Basmati rice in the global market, which has an annual export value of about Rs 50,000 crores. Both India and Pakistan are staking claims over the GI of Basmati. Amid this dispute, New Zealand has rejected India's trademark application for Basmati, following Australia's earlier decision.

New Zealand's stance is that other countries also cultivate fragrant rice, so no single country can exclusively claim it. The Intellectual Property Office of New Zealand (IPONZ) has refused to grant India a trademark certificate equivalent to a GI for Basmati. India’s Agricultural and Processed Food Products Export Development Authority (APEDA) had submitted the application on behalf of the country.

The dispute between India and Pakistan over Basmati has been ongoing for many years. In 2022, Pakistan applied for Basmati's GI status in the European Union (EU). India, objecting to Pakistan’s application, demanded its cancellation. India’s own application for Basmati’s GI status has been pending with the EU since 2018. Pakistan claims it grows Basmati in 44 districts, including areas like Balochistan, where even normal rice is difficult to grow, and four districts in Pakistan-occupied Kashmir. Pakistan aims to increase its share in the global market for this premium rice by obtaining the GI status for Basmati.

To understand the global market issue of Basmati, we need to look back. In 2008, a group was formed in a joint meeting between India and Pakistan to address the GI status of Basmati. Joint secretary-level officials from both countries signed an agreement that recognized 14 districts in Pakistan and seven Indian states (Punjab, Haryana, Western Uttar Pradesh, Himachal Pradesh, Uttarakhand, Delhi, and Jammu & Kashmir) as Basmati production areas. It was decided that both countries would jointly apply for the GI tag for Basmati, but deteriorating relations shelved the matter.

In 2018, India applied to the EU for the GI tag for Basmati, but the EU put India's application on hold. Pakistan applied in 2022, and the EU fast-tracked its application. According to the Geographical Indication (GI) application criteria, the product must be notified under a GI tag in its country of origin. India enacted a GI law in 1999, whereas Pakistan only did so in 2022, after which it granted the GI tag to Basmati and increased the number of Basmati-producing districts from 14 to 48, including four districts of Pakistan-occupied Kashmir. India was unaware of this until Pakistan’s EU application was made public for objections, revealing Pakistan’s strategy.

Upon learning this, the Indian government took swift action, and meetings were held between the Ministry of Commerce, Ministry of Agriculture, and scientists from the Indian Council of Agricultural Research (ICAR). Some officials suggested including new areas in India’s Basmati production area, but senior officials and agricultural scientists opposed this, stating that sticking to the already established areas based on specific geographical location, climate, and soil quality is in the best interest of India and its farmers.

At the Commerce Ministry, Ministry of External Affairs, and Prime Minister's Office level, it was decided that India would oppose Pakistan’s Basmati application. The strategy is to initiate dialogue between the two countries after Pakistan’s application is rejected by the EU, adhering to the 2008 Joint Group agreement. Only 14 districts in Pakistan will be considered Basmati production areas, and India will produce Basmati in the fixed areas of the seven states.

Interestingly, three objections have been filed in the EU against Pakistan’s Basmati claim: by the Government of India, the Government of Nepal, and Madhya Pradesh. Many scientists and officials in India believe that Basmati production can be tripled within the already designated seven states, covering an additional 6 million hectares. For instance, Punjab currently grows Basmati in 600,000 hectares out of 3 million hectares of paddy, while Haryana’s 600,000 hectares can be doubled. Western Uttar Pradesh could also add 500,000 hectares.

A senior agricultural scientist emphasized that India should maximize its Basmati production within the designated states, as they meet the specific GI criteria. In contrast, Pakistan's inclusion of new districts lacks legal and scientific basis. There is hope that India will successfully challenge Pakistan’s broad claim over Basmati.

Vijay Setia, former president of the All India Rice Exporters Association (AIREA), stated that the organization is opposing Pakistan’s claim and has presented its case through legal channels. While the EU's decision is still pending, New Zealand's recent rejection of India's application has brought the issue back into the spotlight.

Moreover, Pakistan has captured much of the EU's Basmati market due to its lower prices. India's imposition of a minimum export price (MEP) on Basmati last year also negatively impacted exports. Most of India’s Basmati exports go to the UAE, Iran, and other Gulf countries. Therefore, securing the GI tag for Basmati is crucial for India, as it ensures better prices for millions of farmers in the seven Basmati-producing states due to the export market.

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group