Russia Tightens Grip on Grain Industry Amid US Crop Surplus

The Russian government has tightened its control over grain exports in a bid to increase its influence on the global wheat market. This move comes as Western traders Cargill, Viterra, and Louis Dreyfus Co. ceased sourcing grain from Russia in July 2023, leading to a significant consolidation in the industry.

The Russian government has tightened its control over grain exports in a bid to increase its influence on the global wheat market. This move comes as Western traders Cargill, Viterra, and Louis Dreyfus Co. ceased sourcing grain from Russia in July 2023, leading to a significant consolidation in the industry. Now, the four largest local companies—Rodnie Polya, Grain Gates, Aston, and MZK—dominate over 70% of Russian grain exports.

As per a report from the World Grain, the consolidation allows the Russian government to exert tight control over trade flows, potentially using grain exports as a geopolitical tool. The authorities can offer favorable terms or impose restrictions based on political needs, a strategy aimed at securing more power over global grain prices and boosting national revenue.

Struggles Within the Russian Grain Industry

Despite the strategic consolidation, the Russian grain industry is struggling financially. The sector's profitability has been declining, with the average marginal profit projected to drop to 20-25% in 2024, the lowest since 2019. This decline is attributed to high operational costs, excessive state regulation, and rising loan expenses due to increased interest rates.

Unexpected frosts in May further exacerbated the situation, killing harvests in key regions. The Russian Agricultural Ministry's calculations indicate that without state subsidies, profitability would be as low as 15.3%.

Strong US Crop Supplies in 2024

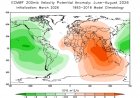

In contrast to the challenges faced by Russia, analysts forecast strong 2024 US wheat, corn, and soybean production. The US Department of Agriculture's (USDA) June reports indicate higher crop condition ratings and adequate supplies, suggesting limited upward price potential.

The USDA's Crop Production and World Agricultural Supply and Demand Estimates (WASDE) reports, released on June 12, highlighted a slight increase in US winter wheat production from the May forecast. The winter wheat harvest is progressing rapidly, with 27% of the crop combined by mid-June, well ahead of previous years.

The USDA's acreage and condition ratings support a positive outlook for the US crop market, with winter wheat rated 49% in good-to-excellent condition as of June 16, compared to 38% a year earlier.

Potential Impact on Global Grain Markets

The contrasting scenarios in Russia and the US could have significant implications for global grain markets. Russia's consolidation may lead to tighter control over wheat prices, potentially creating a grain cartel similar to OPEC for oil. However, the financial struggles within the Russian grain industry may limit its ability to leverage this control effectively.

Meanwhile, the robust US crop supplies and stable prices could benefit global ingredient buyers, ensuring a steady supply of wheat, corn, and soybeans. The key determinant for the US outlook will be favorable summer weather conditions, which could further solidify the positive forecasts.

As Russia seeks to enhance its geopolitical influence through grain exports, the global market will be closely watching the interplay between these two major grain producers.

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group