Bumper Corn Crop in US Moves Global Grain Market

Favourable weather in the US and Brazil, combined with unfavourable conditions in other corn-growing regions, has reduced global prices for corn and changed the flow of corn exports.

Favorable weather in the US and Brazil, along with unfavorable conditions in other corn-growing regions, has lowered global corn prices and altered export patterns. According to S&P Global Commodity Insights, the US corn yield surged to a record 183.1 bushels per acre in August, up from 177.3 bushels per acre the previous year. This increase in supply has led to a glut, pushing US corn prices down to $179.72 per metric ton, the lowest since September 2020. Brazilian corn prices also hit a multi-year low at $194.67 per metric ton.

Together, the US and Brazil dominate global corn production, contributing over 107 million metric tons of corn in the 2023–24 marketing year (September-August), out of a global total of 201 million metric tons.

China, the world’s largest corn importer, is seeing reduced domestic demand, further pressuring corn prices. Chinese imports are forecast to remain stable at 23 million metric tons during the 2024–25 marketing year.

A significant shift in China’s corn imports is expected, with a sharp decline in imports from Brazil and a notable increase in imports from the US. China's corn imports from the US are projected to rise by 67.6% year over year in 2024–25, while imports from Brazil are expected to drop by 48.8%. This shift is considered temporary, driven partly by price differences between US and Brazilian corn. In the long run, China is expected to favor Brazilian corn. Brazil plans to offset reduced trade with China through rising domestic demand for ethanol, projected to grow by 19% compared to last year.

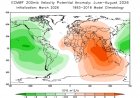

Meanwhile, dry weather in July in Romania, Bulgaria, and Ukraine is likely to push up local corn prices. Cornfields in Eastern Europe are less reliant on irrigation, and extended periods of temperatures exceeding 30°C are expected to cause a 10%-15% decline in production. With higher prices and reduced supply, Ukraine is expected to export less to key buyers like Egypt and Spain. The US and Brazil are likely to benefit from this shift in demand.

Join the RuralVoice whatsapp group

Join the RuralVoice whatsapp group